Optimize Your Energy Asset Siting and Power Offtake Strategies.

.png?width=2420&height=2270&name=GridSite%20Product%20Page%20-%20First%20Section%20(2420%20x%202130%20px).png)

Maximize the Potential of Your Energy Projects.

GridSite™ equips energy industry professionals with the critical market intelligence needed to make informed decisions about asset siting and power offtake strategies. Whether you’re evaluating potential project locations, negotiating PPAs, or conducting long-term market analysis, GridSite provides the comprehensive data and insights necessary to assess pricing trends and revenue potential across all ISO regions.

With detailed historical and forecasted nodal pricing, visibility into the market drivers behind price fluctuations, and intelligence on upcoming changes to generation, transmission, and load centers, GridSite empowers developers to make confident asset siting decisions. Additionally, its benchmarking capabilities allow users to compare prospective projects against operational assets, ensuring a clear understanding of competitive positioning and market viability.

KEY BENEFITS

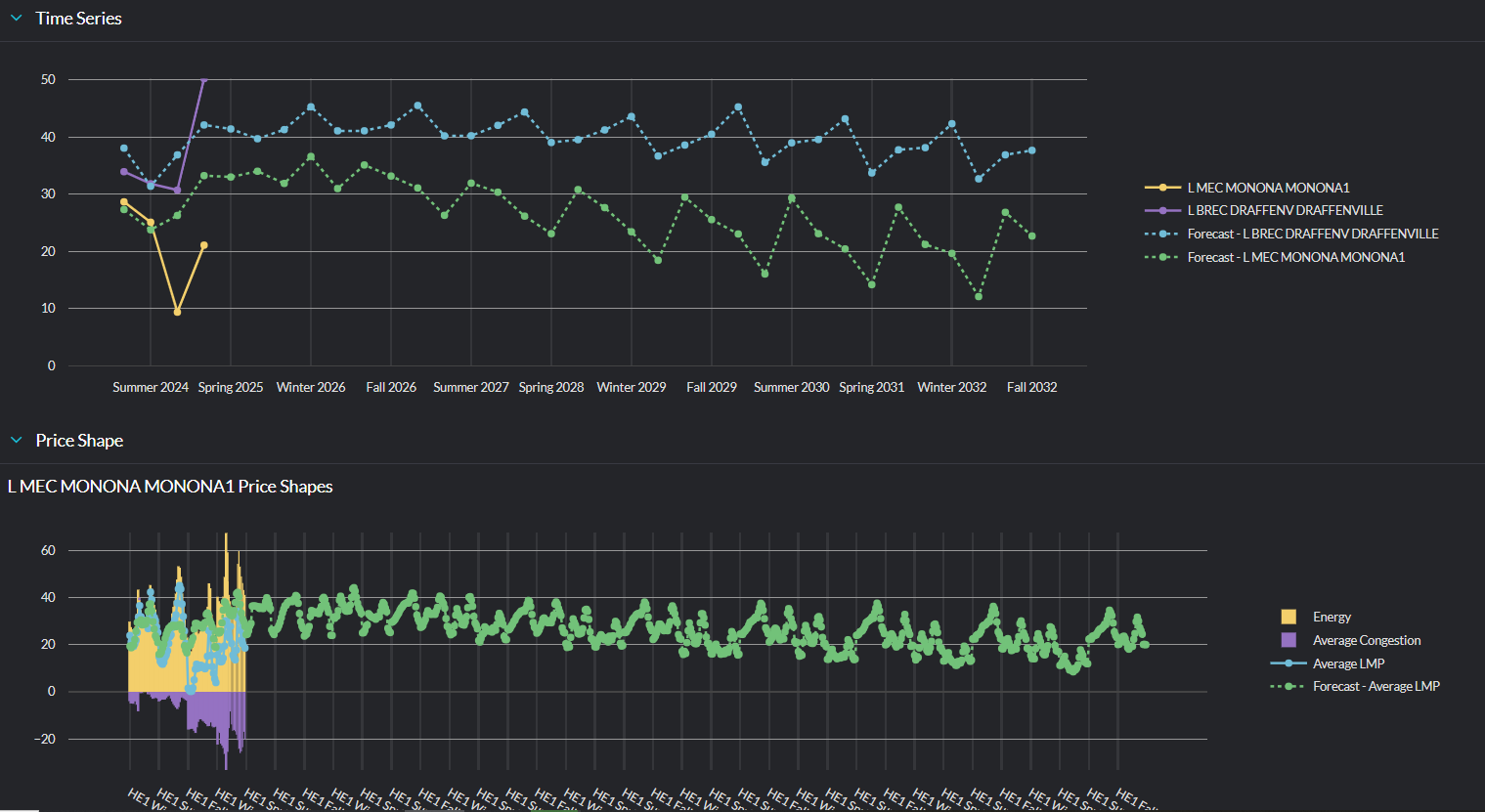

- Make informed investment decisions with a transparent, bankable long-term nodal LMP forecast that provides hourly price projections through 2050. Covering 100,000 nodes, it incorporates key market drivers such as generation expansion, load growth, emissions, and fuel price trends.

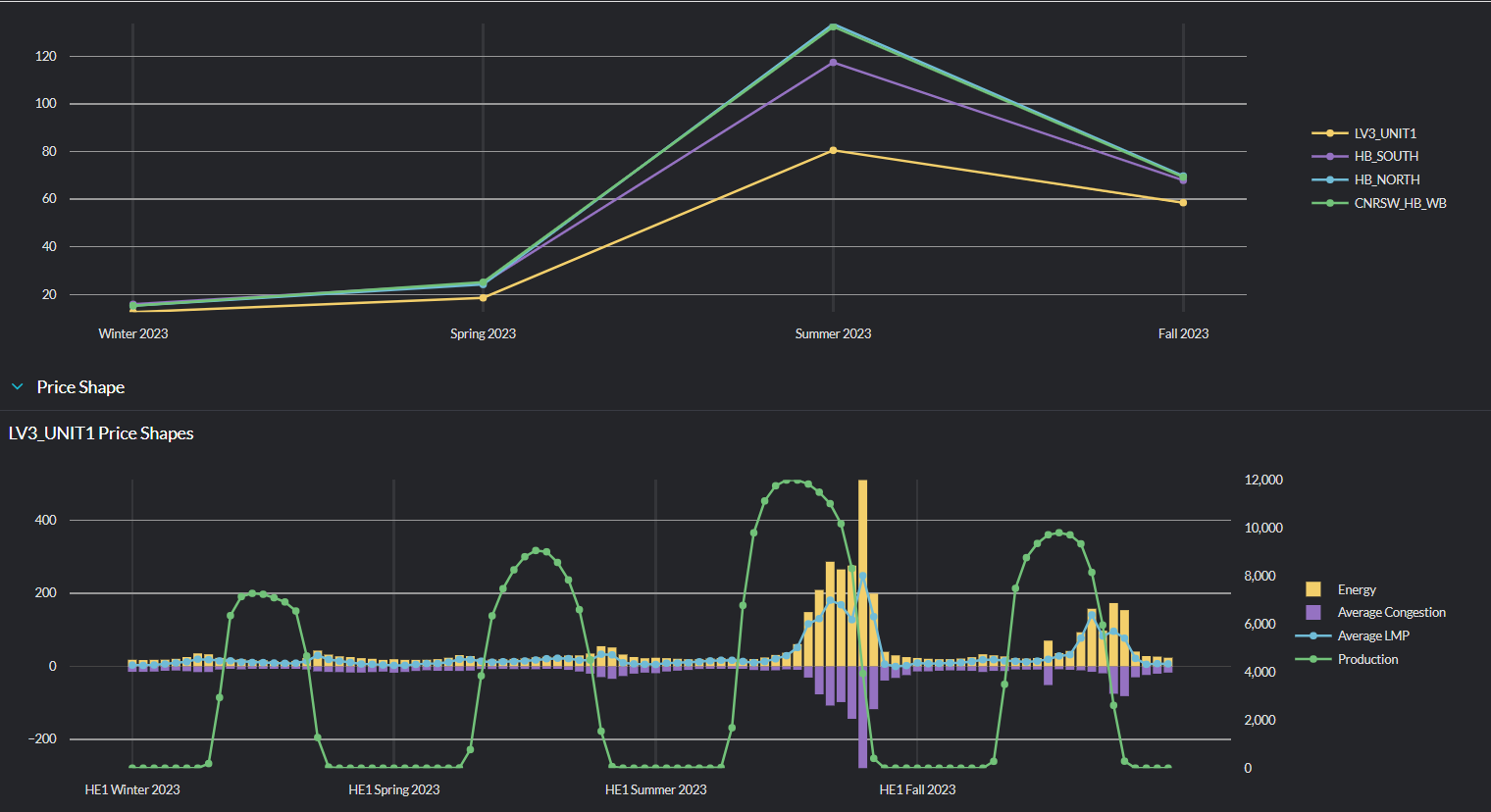

- Analyze historical pricing trends and market drivers with advanced tools and interactive maps. Gain insights into LMPs, basis risk, production-weighted pricing, and the impact of load, generation, and congestion.

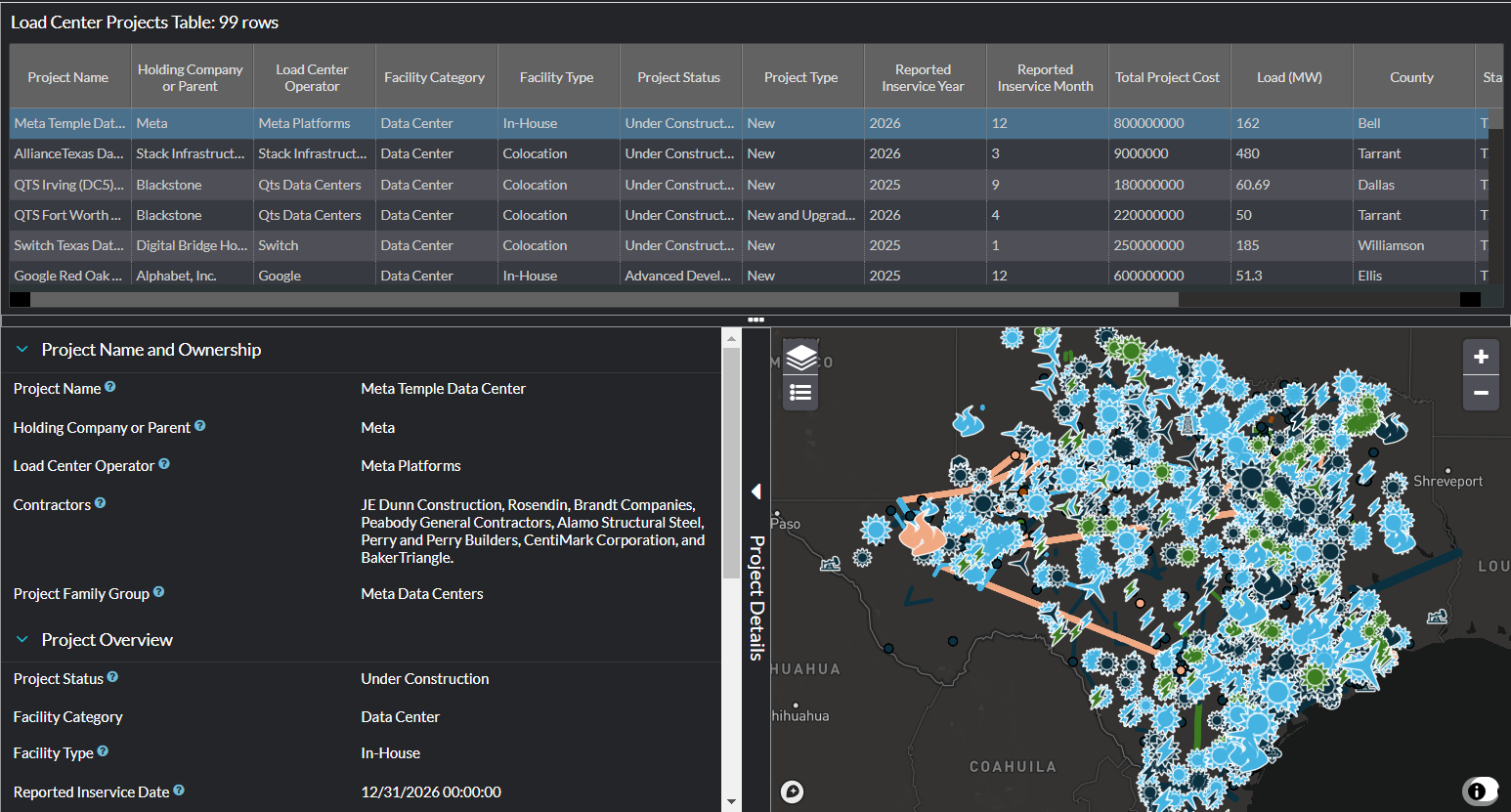

- Stay ahead of infrastructure changes with a tool that consolidates ISO interconnection queue data and hundreds of other sources to track upcoming generation, transmission, and load center developments.

- Benchmark asset performance and revenue potential by analyzing the operations, revenue streams, and offtake agreements of existing projects in your target market.

UNMATCHED DATA TRANSPARENCY FOR CONFIDENT DECISION-MAKING

GridSite delivers fully transparent, fundamental forecasts alongside the industry’s most comprehensive historical nodal pricing dataset. Asset developers can rely on high-quality data sourced from public, partner, and proprietary sources, meticulously cleaned and standardized for ease of use.

Continuously monitored and updated by a team of power market experts, this data empowers confident, data-driven decisions—providing a competitive edge in an increasingly dynamic energy market.

FAQ about Our Energy Asset Siting and Offtake Solution

GridSite is built for organizations developing or siting energy assets impacted by wholesale power prices. This includes:

- Independent Power Producers (IPPs)

- Energy Asset Developers

- Data Center Developers

- Crypto Mining Operators

- Utilities

These companies use GridSite to evaluate project locations, analyze revenue potential, and make more informed, cost-effective siting decisions — without relying on expensive consultant studies.

GridSite differentiates itself with best-in-class capabilities in several key areas:

- Historic Pricing and Drivers:

- Most accurate and extensive historic nodal price data

- Best mapping and analytical tools

- High data granularity for in-depth analysis

- Forecast Pricing and Drivers:

- Fundamental forecast with transparent assumptions and methodology

- Hourly locational marginal pricing (LMP) forecasts to 2050

- Covers more than 100,000 nodes US-wide

- Forecasts are used in actual project financing (“bankable”)

- Queue Data:

- Most up-to-date and accurate data, with deep insight into upcoming plants, transmission lines, and load centers

- Plant Benchmarking:

- Electric quarterly reports (EQR) data mapped to operating plants, sellers, and buyers for plant and PPA benchmarking analysis.

- plant and PPA benchmarking analysis

|

Analysis Type |

Description |

|

Historic Pricing and Drivers |

It has analytical tools to understand historic pricing over time and the market fundamentals that drove pricing, including map and chart views. |

|

Price Forecasting |

It providesa long-term, hourly, nodal-level forecast and congestion forecast out to 2050. This includes all buses across the US, along with assumptions on generation build-out, load growth, emissions, and fuel prices. |

|

Upcoming Grid Changes and Queue Data |

It’s a tool to understand upcoming changes to power infrastructure including upcoming generation, transmission, and load centers. |

|

Plant Benchmarking |

It’s a solution to understand the operations and revenue of existing assets for benchmarking purposes. |

You can rely on GridSite’s forecast because:

- It’s built by a team of industry experts with over 50 combined years of long-term price forecasting using powerflow models.

- It uses a fundamental powerflow model, ensuring physical and economic consistency.

- Clients have used the forecast to finance assets (i.e., it’s considered bankable).

- The forecast includes assumptions for generation buildout, transmission expansion, emissions, and fuel prices.

- It's updated twice per year with documented assumptions and release notes.

MORE INSIGHTS

Optimize Renewable Energy Development with EnCompass 8.0 Now Available

What to Know about PJM Plant Retirements